Small business, Debt, Loan, Predatory lending, Mortgage loan, Interest

After 1 Year of PPP, a Former SBA Official on the 'Herculean' Effort Getting the $750 Billion Program Off the Ground

The forgivable loan program has helped millions of small businesses access about $750 billion in aid. Bill Briggs was there for it all.

After 1 Year of PPP, a Former SBA Official on the 'Herculean' Effort Getting the $750 Billion Program Off the Ground

The forgivable loan program has helped millions of small businesses access about $750 billion in aid. Bill Briggs was there for it all.

We are sorry, we could not find the related article

If you are curious about Future of Work Essentials and Leadership

Please click on:

Or signup to our newsletters

Emergency small business loans helped, but they won't be enough

Congress' $650 billion forgivable loan program helped small business owners keep millions of people on their payrolls as states imposed shutdowns, but some lawmakers and economists say more ...

PPP had its strengths. Its successor can be stronger.

A public-private partnership that has fewer rules and restrictions than the Paycheck Protection Program would save more small businesses.

Paycheck relief loans give fintech a chance to showcase strengths

Financial technology firms want to showcase their ability to get government aid to businesses quickly during the pandemic.

The Good, the Bad, and the Ugly of PPP Loan Forgiveness Delays

Some banks aren't even ready to process PPP loan forgiveness applications--nearly a month after the SBA program launched. Why that's going to put a lot of business owners in a bind.

AmEx’s purchase of online lender Kabbage left desperate PPP borrowers in the cold

When American Express bought "substantially all" of Kabbage last year, the loan business it left behind was drained of the resources needed for the PPP program.

Small business rescue slowed by fight against fraud, drawing protests

The Small Business Administration revealed plans Wednesday to speed up the process and keep the government-guaranteed loans flowing.

PPP Money Abounded—but Some Got It Faster Than Others

Six months after launching the biggest small business aid initiative in history, Congress is working to extend the Paycheck Protection Program, but with new measures to ensure the most ...

PPP Forgivable Loans Will be Unforgiving for Many

Business who don't bring back their entire workforce will have their eligible forgiveness amount reduced.

Startups and SBA Loans

Last week Congress passed the CARES Act which provides a vast array of financial relief provisions to people and businesses in the US. Congress is providing relief to small businesses via a ...

VC-backed biotechs may be excluded from coronavirus loan program

Venture-backed companies may be shut out of an emergency forgivable loan program for small businesses created by the Coronavirus Aid, Relief, and Economic Security (CARES) Act unless the ...

Public PPP Loan Data Strips Anonymity From Private Firms

Fuse Financial Partners received a $150,000 potentially forgivable loan through the Paycheck Protection Program (PPP), created by Congress as part of the federal CARES Act. Paying the Piper ...

Minority businesses worry they are locked out of payroll lending program

As the government issues a second round of aid for small business owners, some U.S. senators, community banking groups and minority-owned banks said they are worried businesses owned by ...

Need A Loan Now That The Paycheck Protection Program Is Running Again? Try These Nonbank Lenders

If you’ve been unable to apply for a PPP loan through a national or regional bank, below are nonbank and alternative lenders to consider—plus some tips on how to evaluate them.

Navigating COVID-19: A Flight Plan for Small Business Owners

There are two main loan programs currently available to the aviation small biz community, Economic Injury Disaster Loans and Paycheck Protection Program Loans. The CARES Act provides more ...

Unapproved online lenders want a piece of the new coronavirus loan program for small businesses

Online lenders, or "fintechs," have flooded the small business loan market in recent years. Now some want a piece of the new SBA coronavirus loan program.

New SBA PPP loans now available from community banks

U.S. businesses can apply for new Paycheck Protection Program loans beginning today as the Small Business Administration has opened a new round of funding through community financial ...

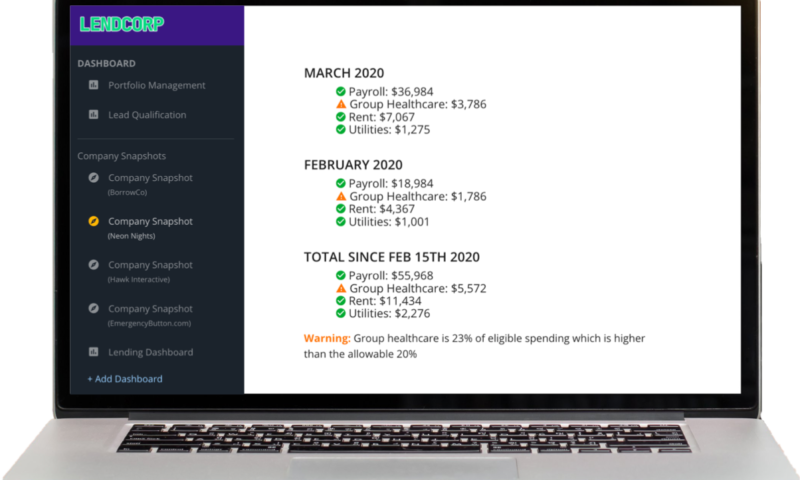

Oracle inks deal with Boss Insights for PPP lending tech

Global software company Oracle has teamed up with Boss Insights, a Toronto-based startup to launch a Paycheck Protection Program platform that addresses loan

What the Second Round of CARES Act Funding Means for Restaurants

The next round of funding for the CARES Act is set to pass through Congress this week after Senate approval on Tuesday. It includes $310 billion to replenish Paycheck Protection Program ...

The Role of Fintech Lenders in the Paycheck Protection Program

The latest regulations coupled with the Treasury Department guidance have left many scratching their heads as to whether fintech companies will be...

COVID-19: CARES Act & The Paycheck Protection Program

For small businesses, the highlight of the available relief under the CARES Act is what is called the "Paycheck Protection Program"