Top news of the week: 27.12.2022.

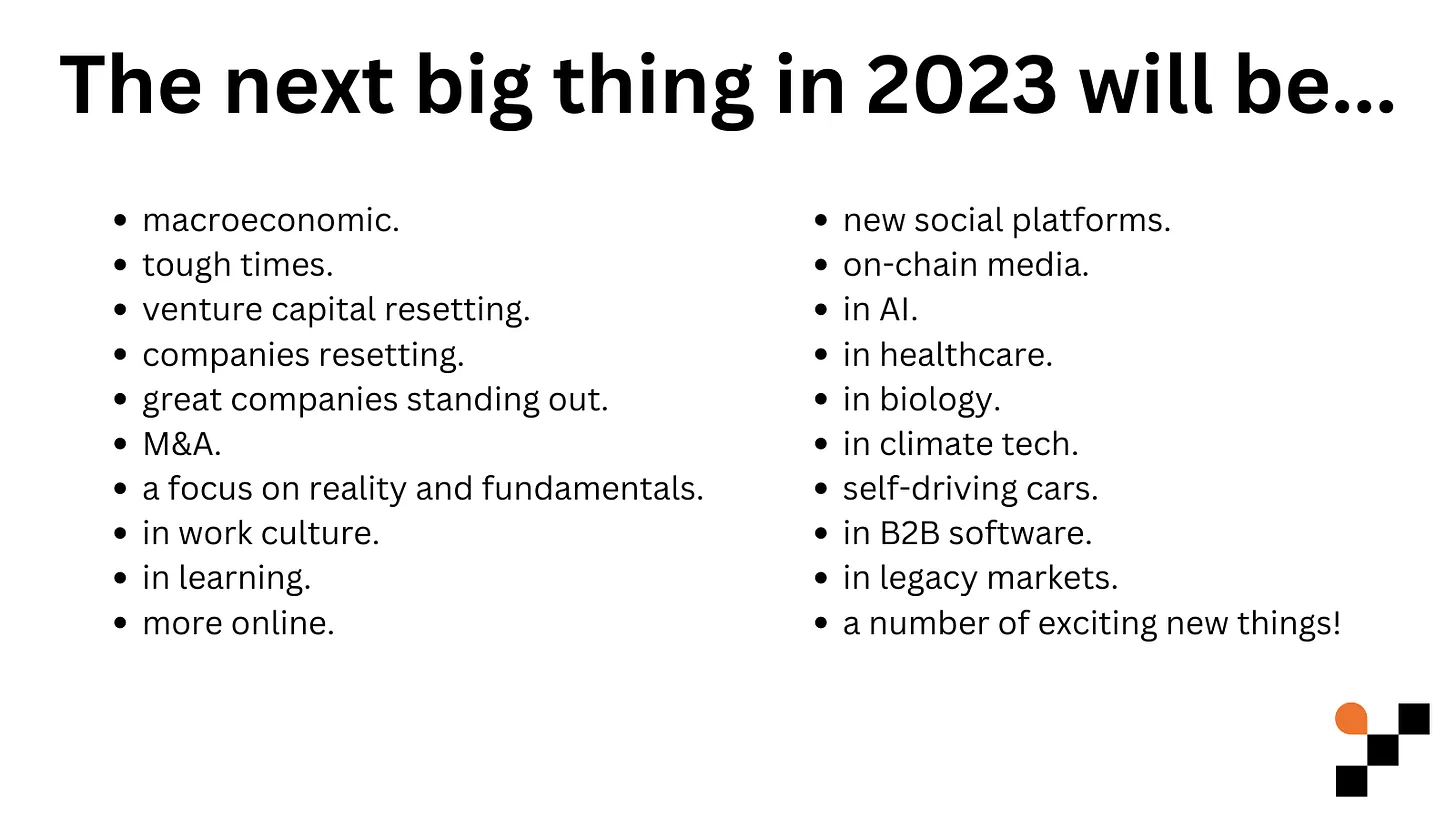

The next big thing in 2023 will be...

For the third year in a row, 50 of technology's top thinkers weigh in on the year ahead.

India: PE-VC exit value more than halves in 2022 as investors hold on to portfolio

Fund managers encashed $16.7b from exits this year, as against $37b in 2021.

SWVL said to have shut down ops in Pak, new startup Buscaro picks up biz

Buscaro is said to be taking over B2B business from former SWVL clients.

Down but not out: Indian SaaS industry applies ‘test’ match lens to growth in 2023

From focus on growth at all costs and experimentation to cutting costs and slower growth, 2022 has been a mixed bag for Indian SaaS companies.

Top 10 Startup Bharat stories that wrested attention this year

YourStory launched Startup Bharat series in January 2019. As we bid adieu to 2022, here are 10 Startup Bharat stories that made the most waves in this year

Climate tech startups show promise but faster adoption is needed in 2023

Increasing awareness of climate change and technological transformations have unlocked new pathways for startups in the sector.

10 entrepreneurship books of 2022 on the highs and lows of building a startup

YourStory picks 10 books on entrepreneurship and the startup ecosystem that stood out this year.

Flipkart completes full separation of PhonePe

As part of the transaction, the shareholders of the Singapore entities of both firms have purchased shares directly in PhonePe’s India entity.