Top news of the week: 30.01.2023.

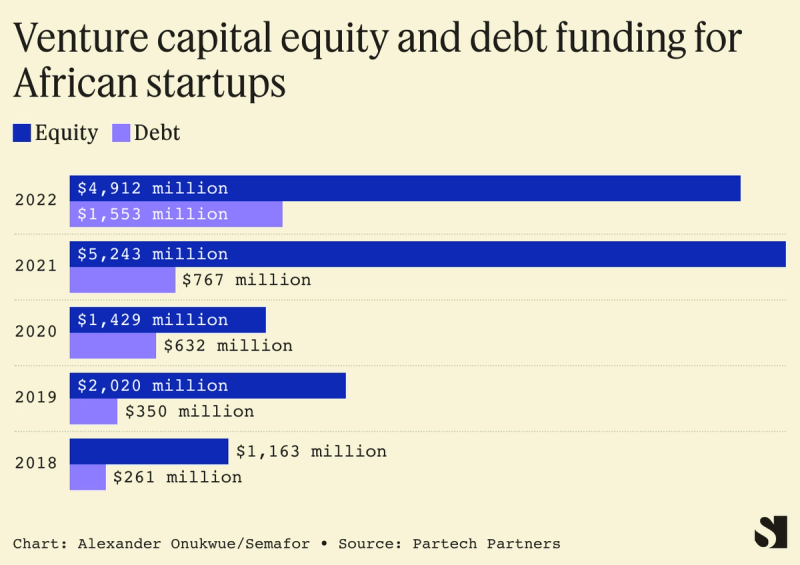

Debt funding is on the rise at African startups

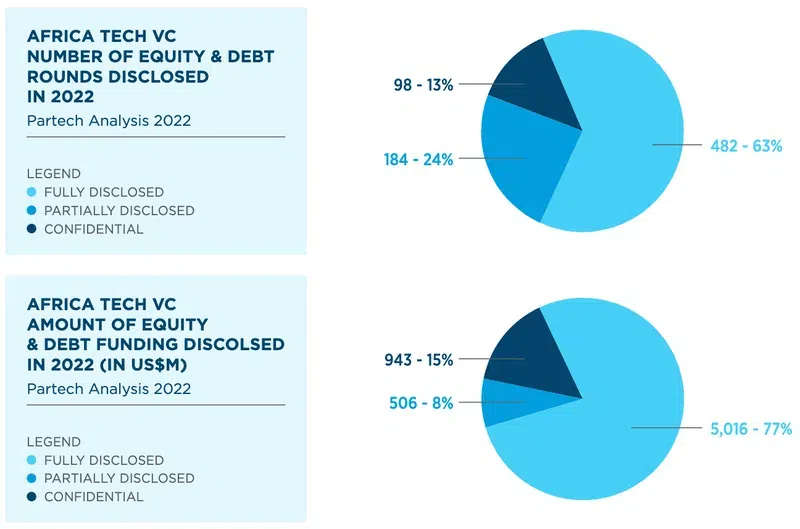

Equity still made up over three-quarters of funds African startups raised last year. But the year-on-year increase in debt financing, in deal volume and dollar value, was unprecedented.

CBN’s regulatory sandbox goes live as regulator seeks to improve quality of financial services in Nigeria

The CBN has announced that its regulatory sandbox is live as it seeks to improve the quality of financial services in the country.

How African startups raised venture capital in 2022

African tech slightly raised more venture capital in 2022 than it did the year before. One major driver of that growth is the uptake in venture debt.

African tech ecosystem grows with $6.5b raised in 2022

Partech Africa, the VC fund dedicated to technology start-ups in Africa, has issued its annual report on Africa Tech Venture Capital.

11 startups selected for 3rd ASIP Accelerator powered by Startupbootcamp AfriTech

Startupbootcamp AfriTech and telecom firm Telecel Group have selected 11 startups to take part in the third edition of the Africa Startup Initiative Program (ASIP) accelerator.

Seedstars' masterplan to accelerate the first global generation of VCs

Seedstars has been at the forefront of the rapidly globalizing startup world for years. Their new endeavor has the potential to solve a lingering problem in emerging ecosystems.

Why 1% of venture financing matters more than you think in Africa

Digging deeper into the data