Top news of the week: 29.05.2022.

General News

Viola Credit closes $700M fund to provide asset-based lending FinTech startups

Fintech startup and alternative credit asset manager Viola Credit, has closed its latest $700 million fund which provides asset-based lending capital to FinTech, PropTech, and InsurTech ...

Spiros Margaris and CAT Financial Products launch first active fintech value investment solution

In a partnership with CAT Financial Products AG (CATFP), he gives investors the chance to invest diversified and in a simple way in the global Fintech companies that not only have …

AI reskilling: A solution to the worker crisis

With AI technology opening new opportunities, financial services workers want AI reskilling to leverage AI tools and advance their careers.

Open banking: Balancing innovation with security

After years of stop-start evolution, the market boom that open-banking advocates have been waiting for appears to be underway. The potential of this sector is as large as it is untapped ...

5 Ways The Banking Industry Can Build Value During Economic Downturn

Banks improving productivity and invest in strategic growth will emerge from an economic downturn more future-ready than the competition.

CFPB scraps fintech sandbox program with changes to innovation office

The bureau’s new office of competition and innovation will promote competition, host events and seek to make it easier for consumers to switch financial providers.

JPMorgan just outlined its most detailed plan yet for increased spending on tech and fintech products, despite investor criticisms. Here are 9 slides laying out the playbook.

JPMorgan Chase has caught scrutiny for the pace of its investments in the bank. During its investor day Monday, bank execs lifted the hood on more than $14 billion in tech spending.

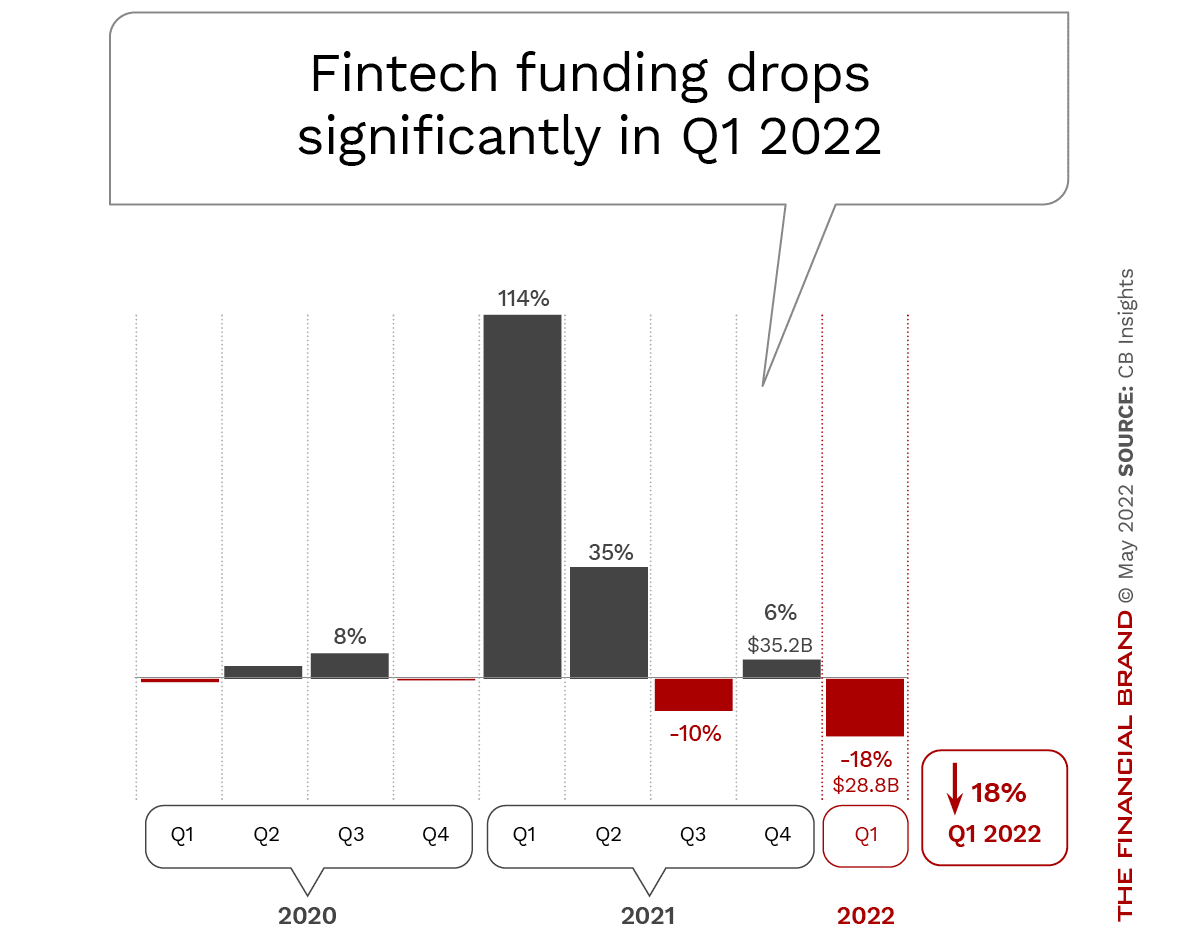

Fintech startups are in serious trouble

Funding soared in 2021. Now valuations are in free-fall.