Top news of the week: 13.07.2021.

General News

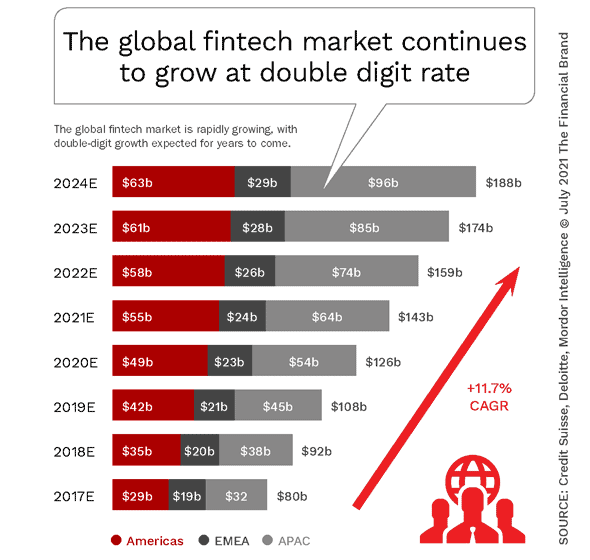

8 Fintech Trends Changing Banking Forever

Banks and credit unions should view trends in the fintech space to determine where threats and opportunities exist and where resources should be deployed.

London fintech funding soars in first half of the year

Fintech companies based in London raised more funding from venture capital investors in the first six months of 2021 than in any other year, demonstrating the British capital's resilience ...

KPMG Report Finds Banking CEOs Focus Investment on Customer Experience Technology and Data Security

While Covid-19 certainly brought disruption to the financial services sector in Saudi Arabia, the sector has weathered the storm well.

Explainer: What is open banking?

U.S. President Joe Biden plans to sign an executive order on Friday that asks the Consumer Financial Protection Bureau (CFPB) to issue rules giving consumers full control of their financial ...

VyStar Credit Union Selects Nymbus as Digital Banking Partner

VyStar Credit Union has chosen Nymbus as its new online and mobile banking solution partner to offer progressive products and member experiences.

Fintech investor Nyca Partners snaps up former regulator to focus on crypto

Matt Homer, who formerly led the New York Department of Financial Services's innovation division, has joined Nyca Partners, the venture capital firm founded by ex-Visa President Hans ...

Tide banking valued at $650m, after securing $100m in funding

Tide Banking has raised over $100m in Series C funding, bringing its valuation to over $650m (£468m), the company announced today.

Best Fintech Startups in USA

During the last decade, fintech or financial technology has emerged as the world’s most promising and dominant sector. It has changed how mobile banking, blockchain apps, and investment ...